Ethereum has been the center of attraction this year, especially during the second half of the year when the merge was anticipated. Lots of cryptocurrencies were predicted to benefit from the merger and that brought bullish hope to investors.

Unfortunately, the expectations have not been met, as a matter of fact, the price of Eth after the Ethereum merge has dropped significantly by about 15%. Nonetheless, expectations are still high and investors are still bullish about it, watching closely how the year will end.

The Ethereum merge price prediction has been positive as well as some other cryptocurrencies that are in one way or the other related to the Ethereum blockchain. You might be thinking if Ethereum is still a good buy after the merge, it will be calming to let you know it is included in our list of top cryptocurrencies to buy after the merge and also in our top 8 cryptocurrencies to buy in October.

In case you still find it difficult to understand the Ethereum merge and how it will work going forward, check out THIS POST and get a clear picture. In the long run, Ethereum certainly will be a good investment since it is also a very good part of Web 3.0 cryptocurrencies.

Certain cryptocurrencies have made their marks in the crypto market amid the market downturn and on that note, here is a list of the top 7 cryptocurrencies to include in your portfolio post the Ethereum merge.

7 Best Cryptocurrencies to Buy After Ethereum Merge

In no particular order, here is the list of cryptocurrencies that you should buy post Ethereum merge.

- Polygon (MATIC). Market Cap $6.721 billion

- Decentraland (MANA). Market Cap $1.270 billion

- Binance Coin (BNB). Market Cap $46.029 billion

- The Sandbox (SAND). Market Cap $1.223 billion

- ApeCoin (APE). Market Cap $1.5 billion

- Solana (SOL). Market Cap $11.470 billion

- Ethereum (ETH). Market Cap $158.308 billion

1. Polygon (MATIC) Market Cap $6.731 billion

Polygon is generally popular for being a premier Layer 2 Ethereum scaling solution. Before the merger, investors turned to Polygon as one of the projects that will benefit indirectly from the major upgrade Ethereum will go through.

Expectations on the asset have been high and so far, it has remained positive. Polygon is the most important layer 2 blockchains on the Ethereum network, so it is safe to say that the hype and excitement that surrounds the Ethereum merge will in one way or another affect the price of MATIC positively.

MATIC is the native token of the Polygon network and it can be used to stake, regulate and also pay gas fees for transactions. According to data from CoinMarketCap today, the price of MATIC is $0.7706 with a market cap of $6.721 billion. Polygon falls within the mid-cap cryptocurrencies.

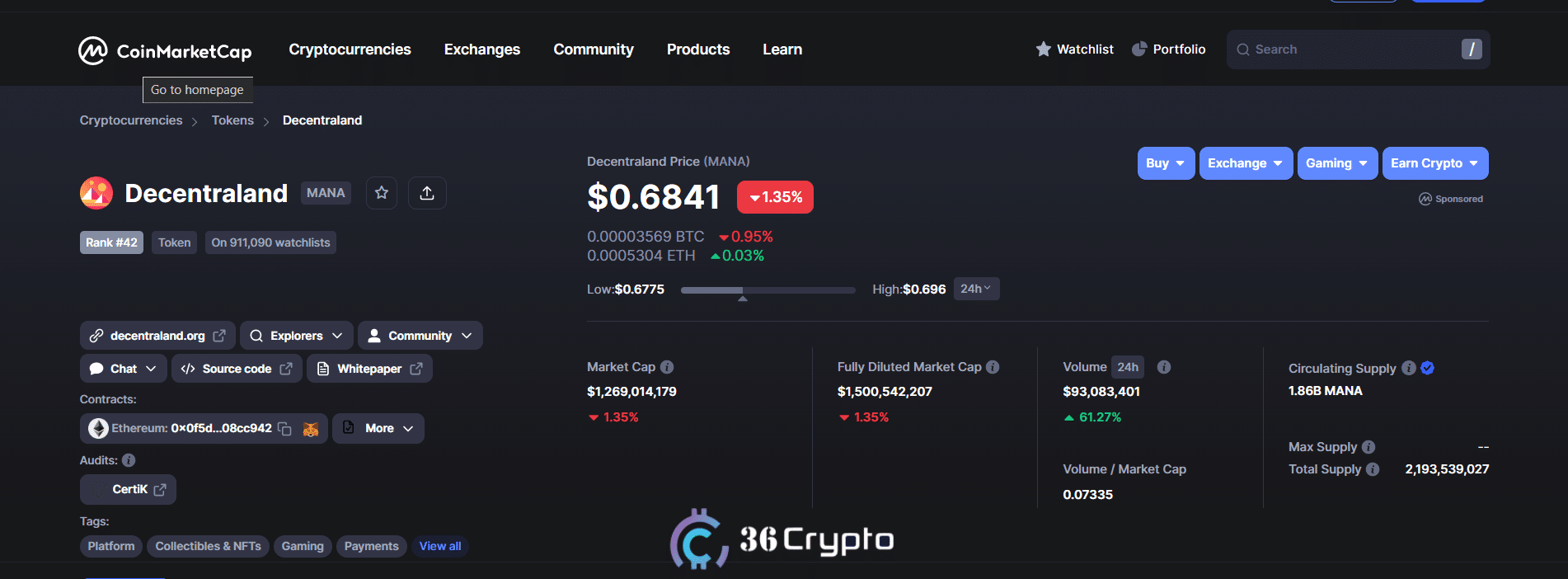

2. Decentraland (MANA). Market Cap $1.270 billion

Decentraland has gained lots of recognition since its creation in 2017. It is a Metaverse project and is definitely among the top Metaverse coins to invest in. Decentraland allows for buying of virtual land and assets and also creates virtual games and establishments.

It is a virtual reality game that operates on Ethereum and uses MANA as its native token. You can also buy goods and services and also visit other players in the game. Since the growing interest in Metaverse gaming, Decentraland is a good investment post-Ethereum merge.

Also, with the buzz surrounding the merger, Decentraland will likely be a positive beneficiary from this. CoinaMarketCap shows that the price for Decentraland is $0.6851 and with a market cap of $1.270 billion.

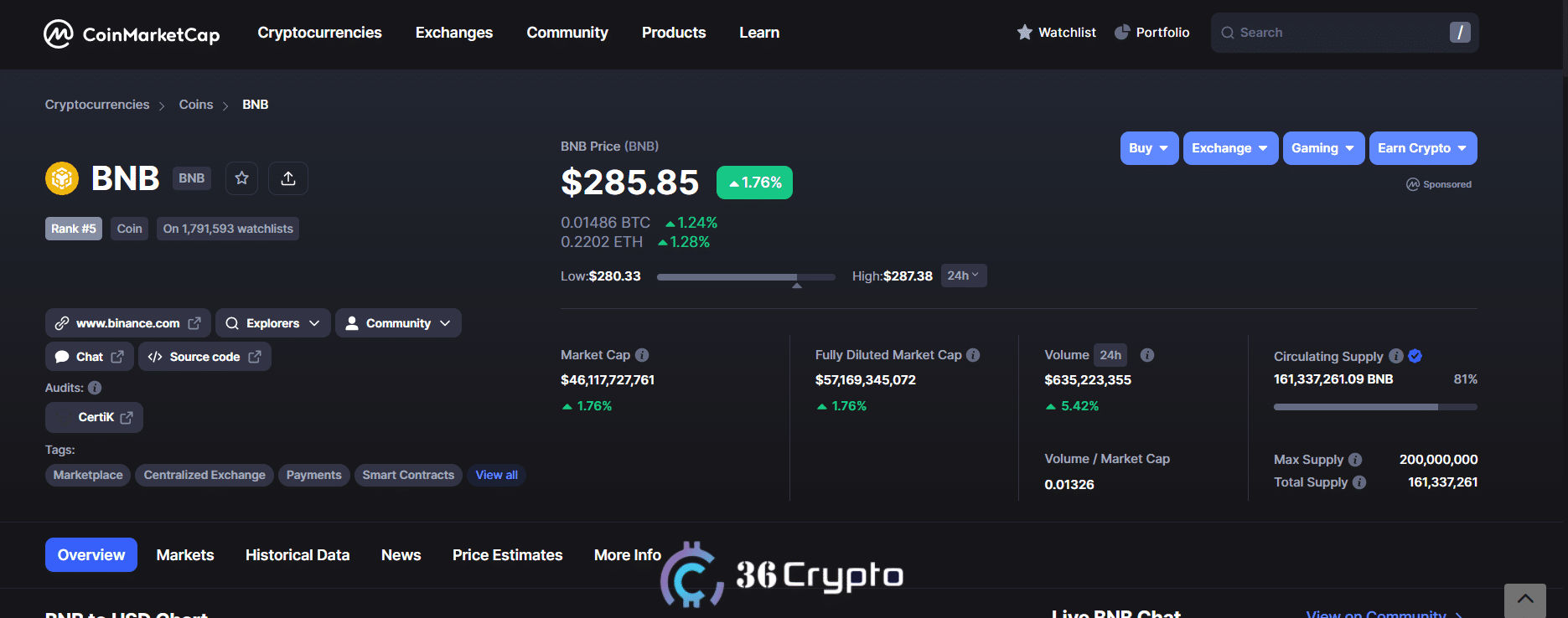

3. Binance Coin (BNB). Market Cap $46.029 billion

We already know that Binance is one of the most popular exchanges and also the largest based on trading volume. The platform has been experiencing tremendous growth since its emergence in 2017.

The cryptocurrency exchange platform supports over 600 cryptocurrencies with BNB (Binance Coin) as the native utility token. BNB supports the Binance smart chain which also houses a range of other cryptocurrencies.

BNB has gained popularity and has risen in price significantly over the years. It has risen to one of the top cryptocurrencies in the market. You can buy BNB on Binance and other major cryptocurrency exchanges.

Data from CoinMarketCap today shows the price of BNB at $285 and with a market cap of $46 billion.

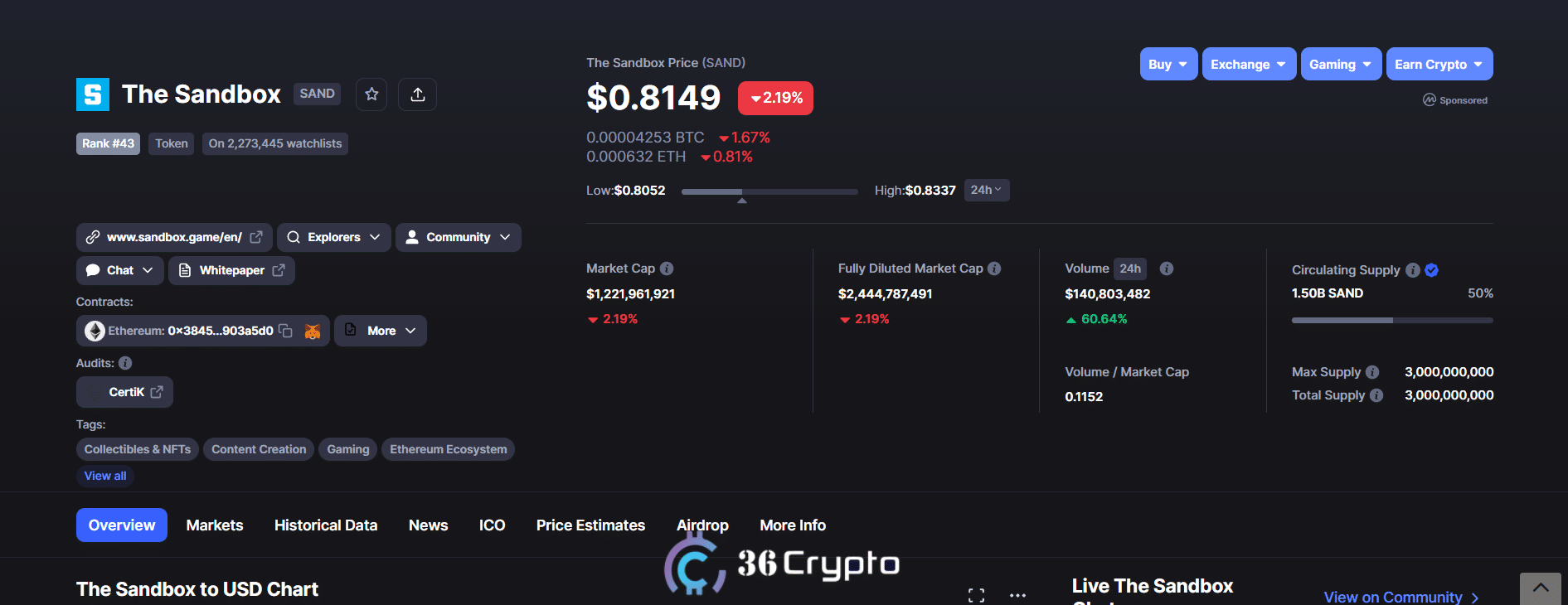

4. The Sandbox (SAND). Market Cap $1.223 billion

Even though the crypto market is experiencing a downtrend right now, Sandbox has been able to remain one of the potentially profitable coins in the market. Sandbox is Ethereum-based virtual gaming that allows users to create digital assets in NFTs, upload them to marketplaces, enhance their gaming experience and also monetize their content.

SAND is the coin associated with the Sandbox. Players can use the coin to purchase digital goods in the game and also participate in Play to Earn games. Due to the rising popularity of the Metaverse, and also the buzz surrounding Ethereum merge, Sandbox will most likely be a good long-term investment.

Today, the price of Sandbox is at $0.816 and has a market cap of $1.22 billion.

5. ApeCoin (APE). Market Cap $1.5 billion

Apecoin is a new trending Ethereum-based cryptocurrency that represents the Bored Ape Yacht Club NFT collection. Since the downturn in the market, many investors are looking for Non-fungible assets which have made ApeCoin one of the tokens of interest.

Since it is based on the Ethereum blockchain, it should positively benefit from the growth of the network in the long run. Anyone holding the ApeCoin token is allowed to cast votes on relevant governance decisions on its decentralized autonomous organization DAO.

The price of ApeCoin as of the time of writing this post is $5.45 and has a market capitalization of $1.5 billion.

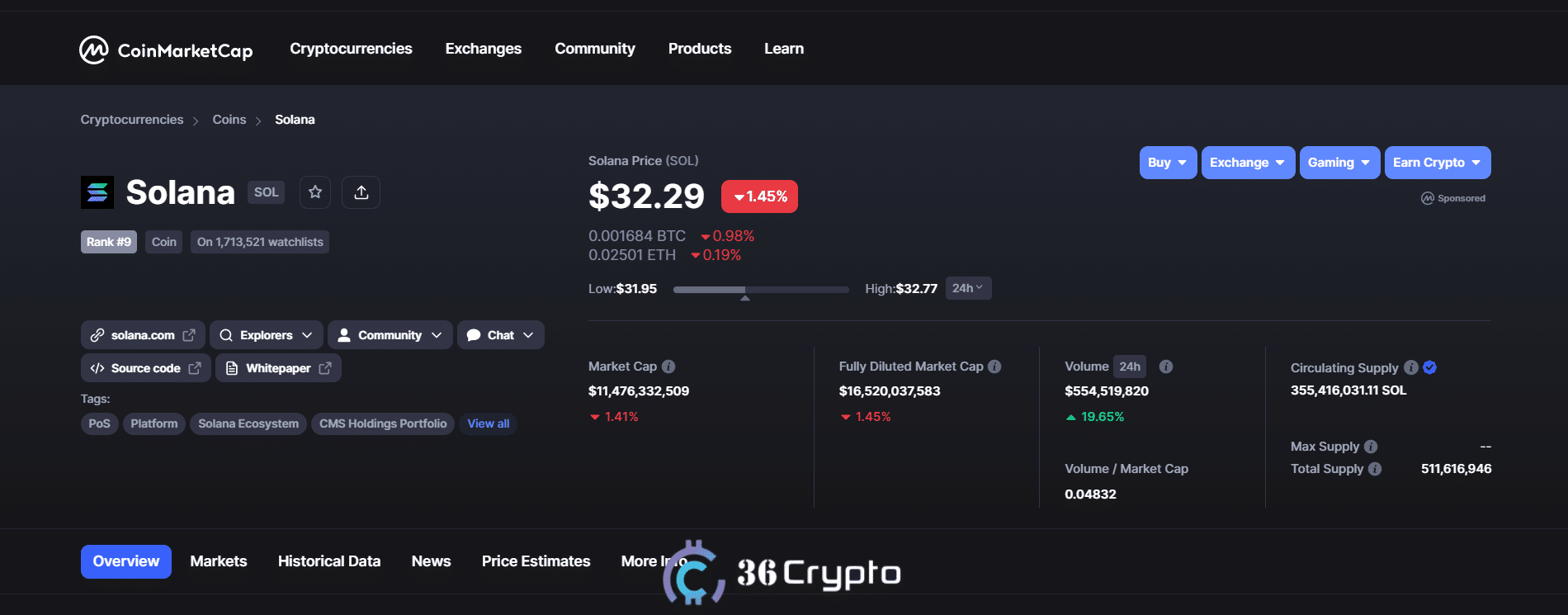

6. Solana (SOL). Market Cap $11.470 billion

Solana is a public blockchain platform that has smart contract functionalities. It operates a decentralized blockchain that enables scalable user-friendly apps. Solana has a much more transaction processing speed than Ethereum and also charges lower fees.

It is an open-source project that was founded in 2017 and is run by the Solana Foundation based in Geneva. SOL is the cryptocurrency that runs on the Solana blockchain. When it comes to Non-fungible tokens, Solana is already one of the most popular blockchains.

With the rise in the interest of NFTs, Solana is certainly one of the projects to look out for and is a good investment post-Ethereum merge. The price of Solana according to data from CoinMarketCap today is $32.51 and has a marketcap of $11 billion.

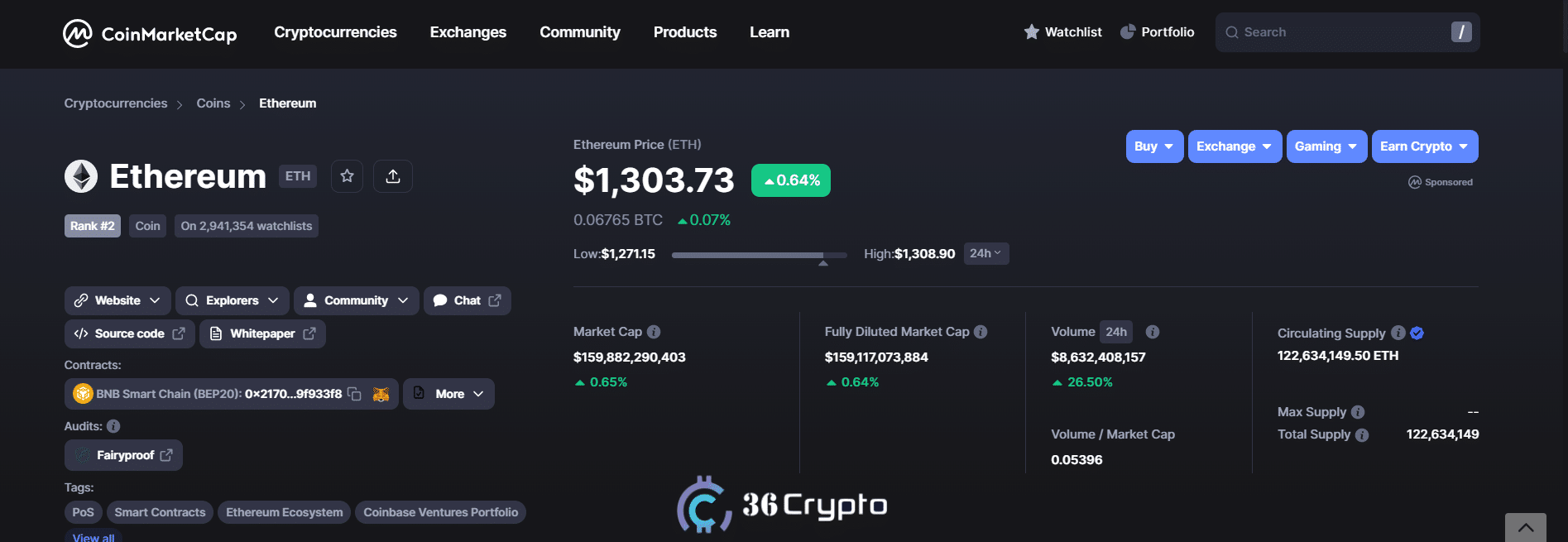

7. Ethereum (ETH). Market Cap $158.308 billion

Our list cannot be complete without including Ethereum. Since the merge, Ethereum has moved from a proof of work mechanism to a proof of stake. Investors have been bullish on Ethereum since the merge.

Ethereum was created in 2015 and has since become the second most popular cryptocurrency after Bitcoin. The Ethereum blockchain supports smart contracts and has many NFTs built on it.

The merger was one of the most anticipated events in the cryptocurrency space. The upgrade helped reduce energy consumption and hopefully, it will positively affect the price of Ethereum in the long run.

Ethereum is certainly one of the cryptocurrencies to buy post the merge. The price of ETH according to CoinMarketCap is $1,297 and has a marketcap of $158 billion.

Conclusion

The Ethereum merge has come and gone, and cryptocurrencies like Solana, Polygon, Apecoin, Decentraland, The Sandbox, Binance Coin BNB, and Ethereum are on our list of coins to invest in.

You should always have it in mind that cryptocurrencies are volatile and is always best to invest in them for long term profit.

Disclaimer: This is not financial advice, always do your research before investing in any digital asset as they are known for their volatility.