XRP has been affected by the ongoing market pullback, with its price declining over 1% in the past 24 hours. Amid this retracement, market analyst MichaelXBT predicted a deeper dip followed by a strong rebound toward significant price milestones.

XRP’s Decline Highlights Key Support Levels

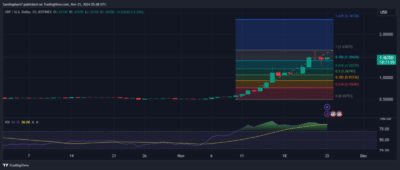

MichaelXBT has reviewed a 4-hour XRP chart showing an ascending channel that started in mid-November and remains relevant. This channel, where HH is greater than the HL, indicates bullish market control. However, the XRP slid when it touched $1.63 on November 23 due to other market pullbacks.

Source: MichaelXBT

Also Read: XRP Soars 71.82% as SEC Chair Gary Gensler Announces Resignation

The rejection at $1.63 triggered a price drop, with XRP initially retreating to $1.41. MichaelXBT anticipated further declines, suggesting the token would retest the channel’s lower trendline, a level crucial for initiating a rebound. This forecast materialized as XRP fell nearly 11% across two consecutive 4-hour candlesticks, hitting a low of $1.2795.

This price point aligned precisely with the channel’s lower boundary, supporting potential bullish momentum.

Recovery Sparks Optimism for XRP’s Future

Since touching the lower trendline, XRP has gained over 14%, climbing from $1.2795 to its current trading price of $1.47. MichaelXBT states this recovery sets the stage for XRP to rechallenge the $1.63 resistance. Breaking through this level could enable the token to retest the upper channel boundary at approximately $1.7.

Source: MichaelXBT

A successful breach of the upper boundary could propel XRP toward its 2021 peak of $1.96, which served as a significant resistance level during that year’s bull run. Self-proclaimed market expert Peter Brandt has pointed out that there is likely to be a strong up-move once this level is penetrated.

Further technical indicators suggest that XRP might aim for the Fibonacci resistance at $2.34 if it surpasses the 2021 high. However, traders are advised to approach cautiously, as XRP’s Relative Strength Index (RSI) currently stands at 86, signaling an overbought condition.

Source: XRP 1D Chart

Conclusion

XRP’s recent movements align closely with predictions of a pullback and recovery, with its ability to sustain the rebound determining whether it can revisit 2021 highs or higher resistance levels. The market’s response to these developments remains pivotal for XRP’s trajectory.

Also Read: XRP Targets $1.5, Pursues ATH Amid Bullish Momentum and Legal Optimism