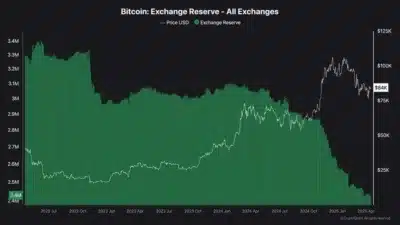

Bitcoin exchange reserves have dropped sharply from around 3.2 million BTC in early 2023 to 2.4 million BTC. This marks the lowest level seen in years and suggests a substantial shift in investor behavior.

The charts from Crypto Banter demonstrate that Bitcoin withdrawal from exchanges points to an increasing trend of long-term holding behavior. The historical data shows that this trend has regularly indicated upcoming market price escalations in earlier periods.

Bitcoin’s price value increased dramatically as exchanges experienced a decrease in their bitcoin reserves. Bitcoin has experienced a significant price increase from its early 2023 value of $16,000 to the current market level of $84,600.

Such an abrupt decrease in Bitcoin holdings on cryptocurrency exchanges indicates lower pressures to sell. Exchange supply availability correlates positively with price gains because growing demand pushes prices upwards.

Also Read: Ripple-Backed XRP Tracker Fund Debuts in Asia, ETF Launch Could Follow

Investor Behavior Reflects Confidence Despite Short-Term Losses

Glassnode’s latest report indicates that short-term holders deal with notable unrealized losses. The “Unrealized Loss per Percent Drawdown” metric has surged to levels typically seen before bear market phases.

However, the absence of capitulation among long-term holders adds a critical dimension to current market sentiment. Historically, only when long-term holders realize significant losses does the market enter confirmed bear territory.

This distinction points to an ongoing confidence among more seasoned investors. The broader market’s bearish attitude is not emerging despite the pressures faced by new buyers.

Technical indicators indicate a changing directional trend pattern. The MACD signal became bullish after the MACD line overtook the signal line across various investment charts.

Source: Tradingview

Bitcoin bounced back to $74,400 after its decline, but must surpass $85,726 before continuing the upward trend. A decisive daily close above the $88,804 price mark will prove a strong breakout toward subsequent targets, extending from $97,693 to potential areas of $112,078 and $126,462.

Fibonacci indicators reveal multiple technical resistance levels that anticipate potential price movement towards $112,078 and $126,462 as secondary and tertiary points.

Analysts expect potential consolidation if Bitcoin fails to reclaim $85,700 in the near term. The likely support zone for such a move lies between $81,000 and $78,000.

Conclusion

While short-term holders face losses, long-term investor resilience and declining exchange reserves shape a bullish setup. Market momentum continues building, with key resistance levels in sight as Bitcoin approaches a potential breakout phase.

Also Read: Ripple’s $1.25B Move Just Unlocked Wall Street Power for Hidden Road